Demand for Investment Professionals in APAC Remains Strong Despite Rough Seas Ahead

By Heidrick & Struggles | Wednesday, 25 Sep 2019Demand for investment professionals in Asia Pacific (APAC) remains strong despite challenging industry conditions, as indicated in results from the sixth edition of Asia Pacific Capital Investment Professional Compensation Survey conducted in the second quarter of 2019 by Heidrick & Struggles.

“Our goal is to provide the industry with the clearest and most up-to-date analysis on how compensation is evolving as private capital matures in Asia Pacific,” said Michael Di Cicco, Regional Managing Partner of Heidrick & Struggles’ Private Equity Practice. “What we’re finding is sustained growth and demand across strategies, which is a really good indicator of long-term health.”

2018 ended as a strong year for private capital in APAC with an aggregate deal value of USD169 billion and assets under management totalling USD883 billion — or 26% of the global total.

The survey included responses from professionals across private equity, venture capital and real assets and it indicated not only that demand is strong but that firms are investing in building their junior and mid-level ranks and in developing teams outside of traditional hubs such as Hong Kong, Singapore or Tokyo.

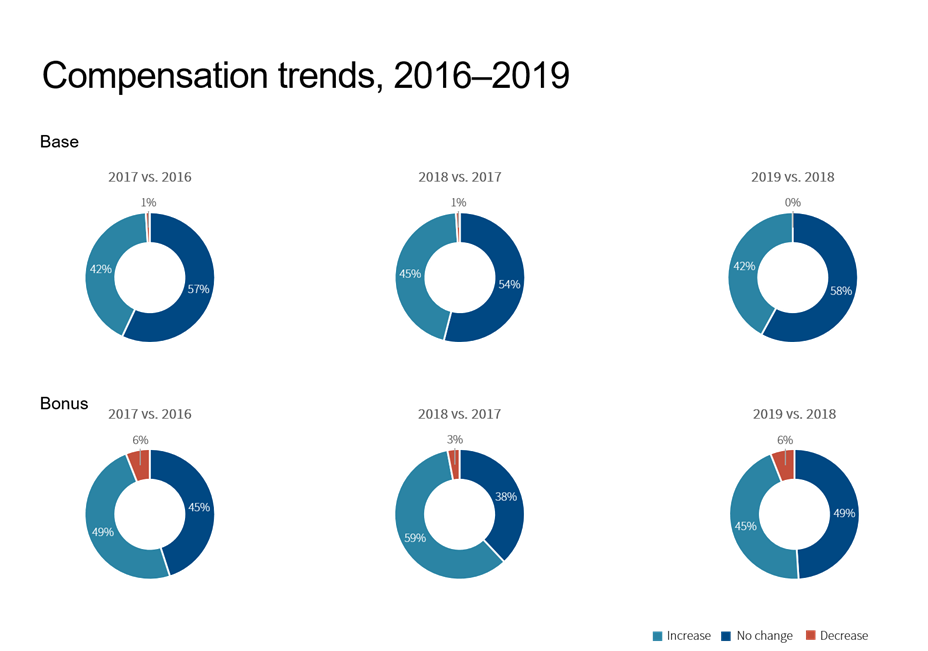

Looking broadly at base salary and bonus changes, 42% of respondents said they received an increase in base salary in 2019, a slight drop from 45% the previous year and returning to the same percentage increase in 2017. The percentage of respondents reporting an increase in annual bonus dropped from previous years; in the latest survey, 45% of respondents said their bonuses increased for 2019, down from 59% for 2018 and 49% for 2017.

In all cases, across investment strategies and geographies, the greatest percentage gains were at the associate and senior associate levels, followed by professionals at the vice president level. The majority of those surveyed remain optimistic that growth will continue, with 65% expecting their base compensation to rise in the next 12 months.

Greater China-based candidates have in the past often been paid a premium compared to other markets. This year’s survey found that has started to change with compensation in other markets closing the gap, particularly for mid-level professionals.

This year, Heidrick & Struggles added compensation data for investment professionals at venture capital firms for the first time as a permanent survey feature. While they have historically tended to pay less generously than those focusing on buyouts, growth capital, or real estate, this year’s data suggests that this, too, is changing.

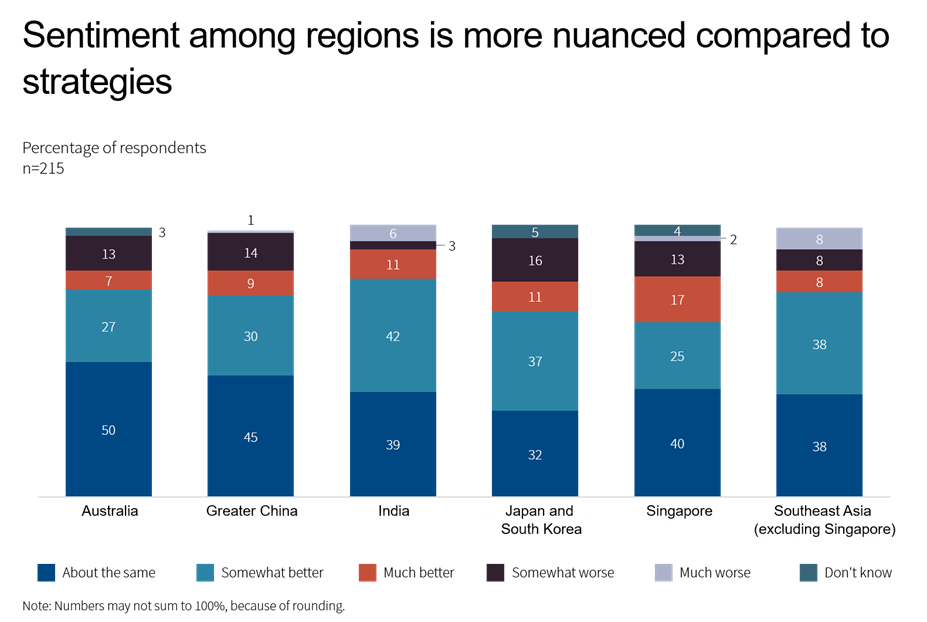

This year’s survey asked respondents to provide context on how they saw the investing landscape in their individual markets through the remainder of this year and into 2020. Taken broadly, investors were optimistic with just 13-16% seeing a decline in investment opportunities. Taking a closer look, India led the pack (53%) with the most positive geographic investment outlook, believing conditions will be somewhat better or much better, followed by Japan and South Korea (48%), Singapore (42%), and Greater China (39%).

The 2018–2019 Asia Pacific Private Capital Investment Professional survey includes responses from 215 investment professionals across the Asia Pacific region who provided their compensation data from 2017, 2018 and 2019, as well as their expectations for changes in compensation in 2019. All data collected is self-reported by private capital investment professionals.

School holidays signal stress for home-workers

School holidays signal stress for home-workers